JM Bullion Review: A Precious Metals IRA Company

Best overall for professionals and Serious Investors

Excellent training and education for customers

Total transparency

Great customer service & reviews

It's important to think about putting a part of your earnings into something that is historically secure, such as Gold & Silver, in light of all the turmoil around the globe.

We have created this Information guide to help you understand how precious metals can be used to diversify your savings.

There is a good reason why so many Americans are using physical gold and/or silver to preserve their hard-earned wealth during these uncertain times.

With the rate of inflation in our times, Social security is no longer enough for retirees and many are beginning to invest their cash to increase savings and have enough money in retirement.

Individual retirement accounts (IRAs) are a unique type of investment accounts where individuals can save for retirement and receive tax benefits by using IRAs. One of such ways people use their IRAs is to invest in precious metals. You can invest in a self-directed IRA or rollover your existing 401k into a gold IRA for better security and more saving opportunities.

American Hartford Gold Group is one of such companies that assist individuals and families in protecting their wealth through diversification with precious metals. Precious metals IRA, Gold IRA Rollover and Silver IRA Rollover are just a few of the services they offer. They also provide physical delivery of silver bars and coins.

American Hartford Gold is also a great option for those who don't wish to open an IRA, but still want to invest in precious metals.

They are one the most prominent companies in this sector and offer a variety of services to clients. American Hartford Gold Group strives to provide the best quality products and services for its clients.

In a Nutshell: American Hartford Gold is one of the Gold IRA companies to consider when looking into rolling over your 401k to a gold IRA account.

About American Hartford Gold

American Hartford Gold in Los Angeles is a family-owned investment company that helps people to invest in precious metals. Some of the available metals they offer include gold, silver and platinum bars and coins. They offer both delivery at one's house or to a retirement account, such as an IRA. 401K. or TSP.

At American Hartford Gold, their mission is to educate clients about the precious metals and gold IRA investment opportunities. They strive for excellence, transparency, and unequalled customer service built on complete trust and integrity. With a 5-star client satisfaction rating on trusted review platforms like Trustpilot and an A+ rating with the Better Business Bureau, It is one of the precious metals company to consider when looking to invest in gold. It is one of America's fastest-growing private companies according to Inc. 5000's 2021 list.

American Hartford Gold has over 100 employees located across two locations; a corporate headquarters located in Los Angeles, CA with an additional corporate office in Woodland Hills, CA.

American Hartford Gold has a buyback program. Not all Gold IRA firms offer this service. Customers can easily sell precious metals through the BuyBack Commitment. This is a three-step liquidation that does not require additional costs. This is a great place to start if you are just starting out in investing in gold and other metals. They guarantee you the best pricing, at all times. American Hartford Gold will match your price to guarantee you the lowest rate.

American Hartford Gold is known for its simplicity. They do everything possible to make sure that the process is smooth from start to finish. The company has demonstrated a strong commitment in trust, communication and customer service. It is easy to have faith in a company that's both trustworthy and knowledgeable. They make the entire process simple and stress-free.

American Hartford Gold Group might be the right choice for you if your goal is to secure your financial future and avoid economic volatility. They have more than 20 years experience in precious metals and can help you get the most accurate information about your retirement planning. For more information about how investing gold or in other precious metals can protect your financial security, call them today.

Rolling Over 401(k) To IRA

You can get tax benefits by rolling your 401K over to IRA. Consumers have more control when rolling over 401K to IRA. This is because, unlike a company plan, an individual retirement accounts (IRAs) allow for a larger range of investments such as stocks and bonds, precious metals etc.

The tax advantages of precious metals stored in an account make them attractive. You may not be subject to tax on any gains you make on investments, depending on which type you have.

Before rolling over or setting up a new self-directed IRA, take some time to read up on the IRS guidelines, rules, and penalties regarding IRAs. First, learn the contribution limits for an IRA based on your age. Exceeding these limits will result in a 6% fee each year until the mistake is corrected.

You also won't be able to withdraw any funds from your account before you reach at least 59 ½ years old. Removing funds before this will lead to a 10% fee, and you'll also owe income tax on the money you withdraw. There are a few exceptions to this rule, which includes death or disability.

American Hartford Gold can help you follow these guidelines with its streamlined, easy-to-understand process and you will always have a team member with you for any questions or assistance during the entire process.

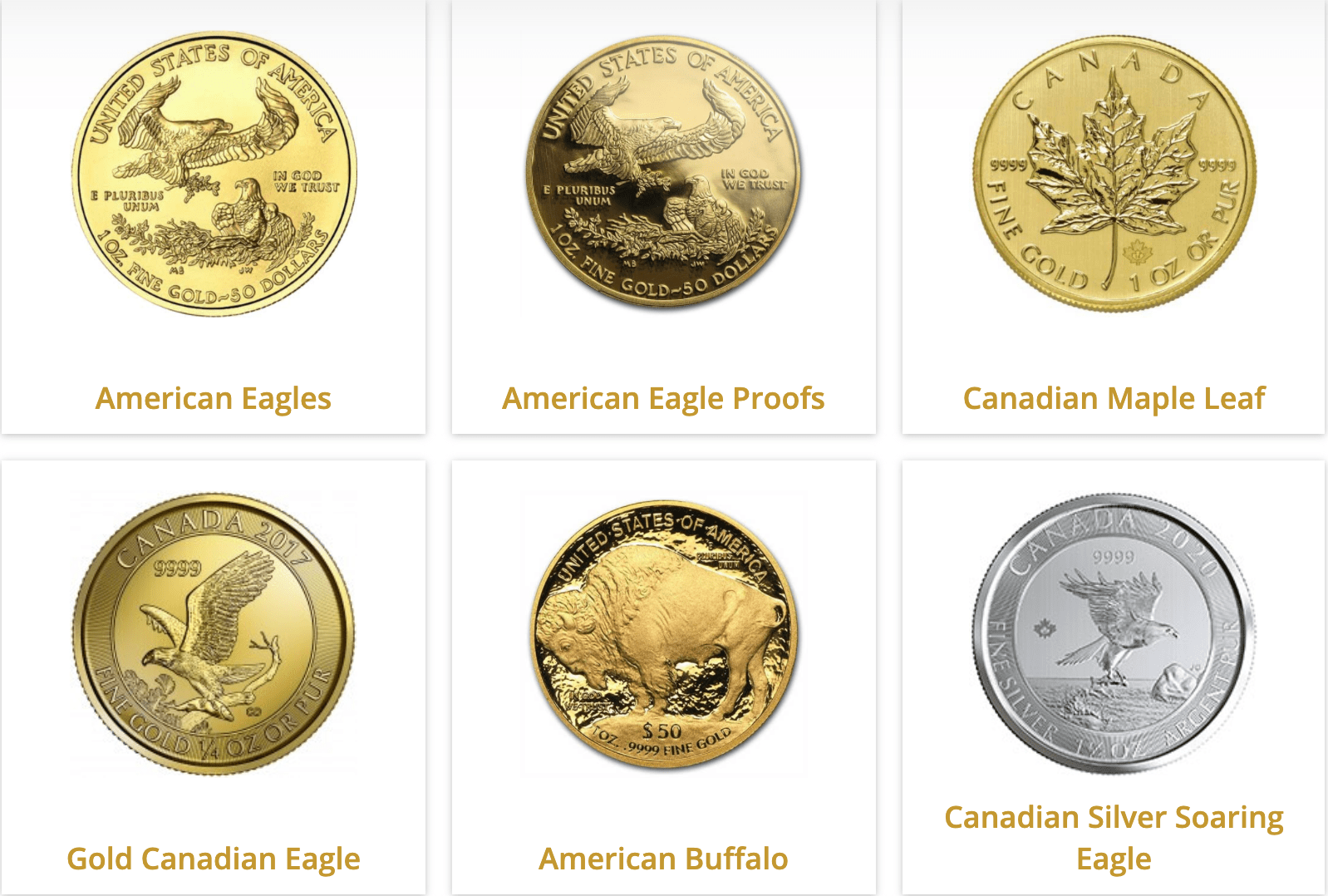

Approved Self Directed IRA Gold Coins From APM

Gold And Silver IRA Coins Offered By Augusta Precious Metals

Gold American Eagle Coins

Gold American Eagle Proofs

Gold Canadian Eagle Coins

Gold American Buffalo Coin

Gold Canadian Maple Leaf Coins

Silver Canadian Soaring Eagle Coins

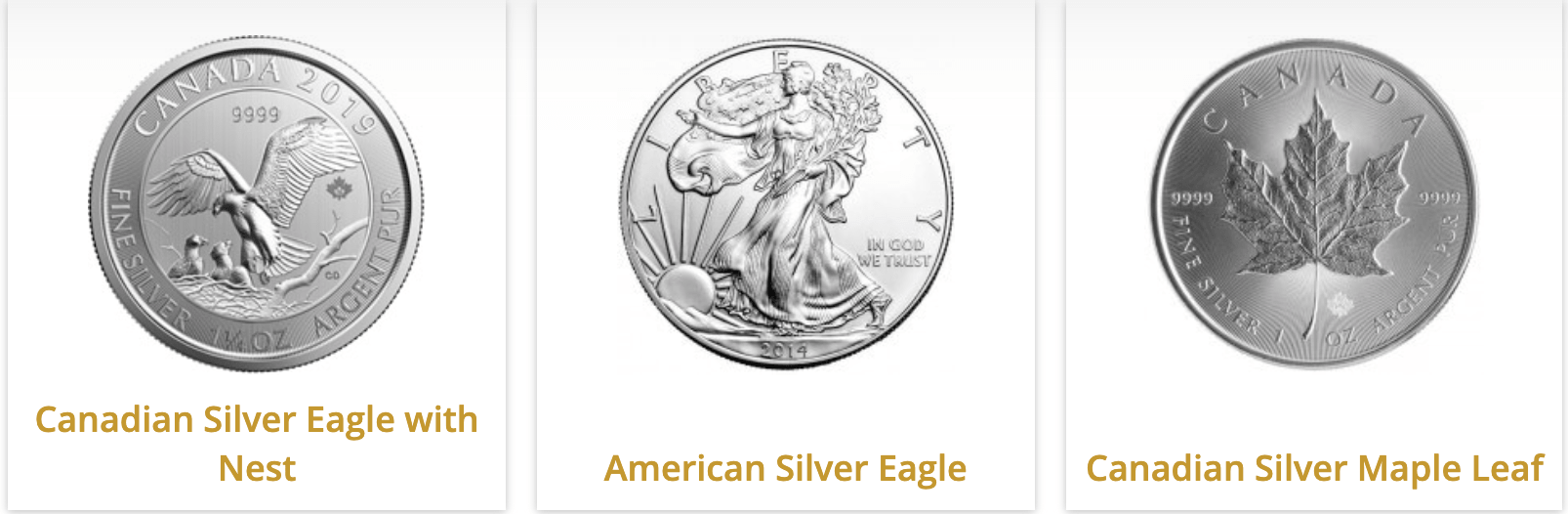

Silver Canadian Eagle with Nest Coins

Silver American Eagle Coins

Silver Canadian Maple Leaf Coins

Why Invest In Gold With Augusta Precious Metals?

With Augusta Precious Metals (APM), the setup for gold IRAs is as simple and hassle-free as you can get, and the APM team always explains each step of the process as they walk customers through it.

The guarantee of lifetime customer support is a winning addition to an already strong lineup of pros and you get some of the best educational materials in the industry at no extra cost.

The availability of an analytics team that is second to none, a wide range of precious metals products of the very highest purity, low fees, and unrivalled third-party storage for IRA metals are some of the benefits you receive when you choose to invest with APM.

Pros

Excellent customer service

Low fees

Secure storage facilities

Hassle-free account setup

Top analytics team

Comprehensive educational materials

Lifetime customer support

Cons

The minimum investment is set to at least $50,000 in a qualified retirement account.

It's nearly impossible to find a "con" for a top company in the industry like APM, but there are a couple, and both are related to minimum account deposits.

To open a gold IRA, there is a $50,000 minimum. For non-IRA metal purchases, the minimum is also $50,000. In fact, the IRA requirement is not all that high, when you consider that a large number of investors are rolling over other IRA accounts that contain that much or more capital.

The more unexpected minimum is the one for non-IRA investors, who often search for excellent companies from whom to purchase precious metals. These types of investors usually do not want to spend $50,000 on an initial purchase.

Getting Started With Augusta Precious Metals

Once you decide to invest in a gold IRA or rollover an existing 401(k), Getting started is simple with Augusta Precious Metals.

You simply fill out a one-page online form, open your account, fund the account, and buy eligible silver and/or gold to put into the account.

The company assigns you a personal agent who can walk you through each step while online. The whole process can be completed in less than 15 minutes. And, if you have any questions, your agent will answer them fully and honestly.

How Does A Gold And Silver IRA Work At APM?

Here is APM's simple and straight-forward 5-step process to get you all set-up

Augusta Fees And Account Minimums

Fees: The quoted metals prices include zero commission fees. The company, APM, pays for all liability insurance and shipping of metals until the customer takes possession or the metals are in the depository. The annual custodial fee is $80 per year and $50 for the application.

Yearly depository fees vary, but are usually around $100 per account. There's about a five percent markup on bullion products, which is low for the industry. Additionally, the company has a plan that allows for a large discount on fees if customers pay them in advance for the expected life of the account.

Minimums: As noted above, gold IRA minimum is $50,000 for account opening. The minimum for non-IRA metals purchases is also $50,000. Here's a bit more information from the company's website FAQ page:

"We do have a minimum order of $50,000 for cash (non-IRA) purchases and $50,000 for IRA purchases. The minimums may be met by purchasing any combination of items you choose.

APM Fees For Precious Metals IRAs

One - Time Fees

Set-up fee for IRA - $50

Annual Fees

Custodian Maintenance fee - $80 - $125 depending on amount invested

Depository fees - $100

APM Fees For Non-IRA Investments Plus APM Investment Minimums

Fees

One time set-up fee- $0

Annual maintenance fee - $0

Storage fee - $0

Investment minimums

Precious Metal IRA - $50,000

Non- IRA Investment - $50,000

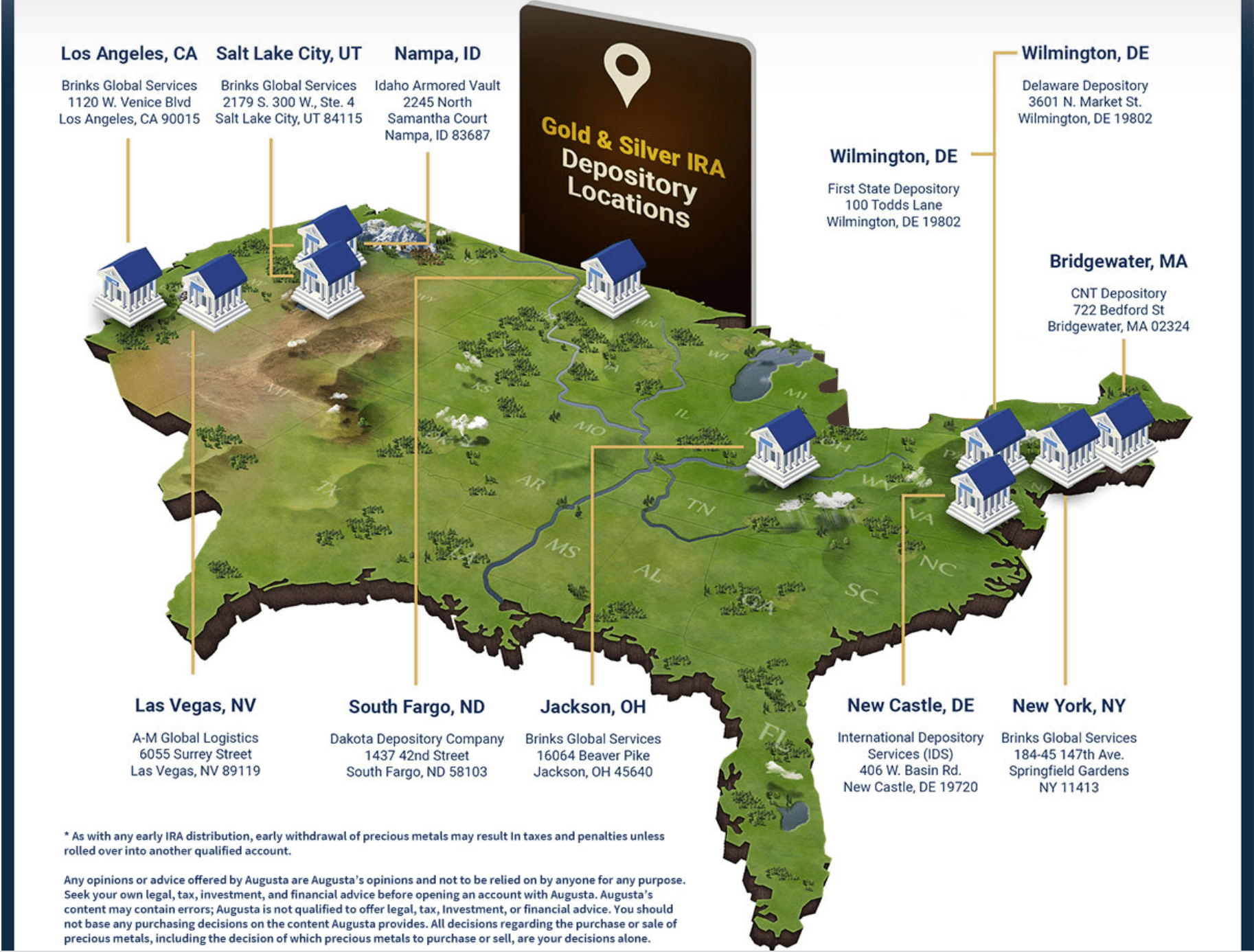

Precious Metals Storage With APM

For customers who open gold IRAs, APM deposits the physical metals in one of several locations, primarily the Delaware Depository. If you don't have an IRA, you need to tell APM where to deposit your metals, whether in one of their depositories or to send the metals directly to you. After you finalize your purchase, the precious metals will be at the storage facility in 7 to 10 days.

The locations of the secure depositories as shown above include:

Los Angeles, California

Las Vegas, Nevada

South Fargo, North Dakota

Nampa, Idaho

New Castle, Delaware

Wilmington, Delaware

New York, New York

Bridgewater, Massachusetts

Jackson, Ohio

Salt Lake City, Utah

What Makes Augusta Precious Metals Unique?

Augusta Precious Metals (APM) can help you set up a self-direct Gold or Silver IRA and they can also help you rollover an existing 401(k).

APM offers a large selection of IRA-approved coins and other gold and silver bullion and premium coins available for purchase.

The company's setup is highly efficient and every step of the process has been streamlined and made simple for an effective collaboration with customers.

APM has built a unique partnership with Canada's government entity, the Royal Canadian Mint (RCM). The result is the company's ability to offer coins and bullion that are exceptionally pure and often cost less than those sold by competitors.

There is a choice of about 10 IRS- approved storage facilities for your IRA gold and silver coins when you choose to invest with Augusta Precious Metals.

Who is Augusta Precious Metals Best For?

APM is a great option for many types of investors, including:

Anyone planning for retirement is the most suitable customer for APM.

Anyone who'd like to rollover part of their 401k to a gold IRA.

Wise young people who know the power of starting and funding a gold IRA while in the early stages of their careers.

In fact, APM has customers of all ages. However, people close to retirement and those already retired tend to be the largest demographic of IRA buyers in the U.S.

Final Thoughts on Augusta Precious Metals

It's difficult to not give APM a five-star rating. Even taking into account their account minimums, the only "negative" factor we could identify, they're still far ahead of their closest competitors in quality of service, purity of precious metals offered, ease of account setup, transparency of fees and charges, expertise, educational materials, pricing of precious metals, overall expertise, and general customer satisfaction.

Frequently Asked Questions About Augusta Precious Metals

Is Augusta Precious Metals legit?

Yes, Augusta Precious Metals is a legitimate company and one of the best in the industry. The United States Mint recognizes it as a bullion dealer. They are rated A+ by the Better Business Bureau and rated Triple A by the Business Consumer Alliance.

What is a gold IRA account?

A gold IRA account is a specialized individual retirement account (IRA) where instead of money or stocks you invest in precious metals like gold, silver, platinum and/or palladium. These physical precious metals are held in a IRS-approved secure storage facility or vault.

What types of silver and gold does the company offer?

Augusta Precious Metals offers silver and gold in forms of bullion bars and coins to premium collectible coins. They do have a wide variety to choose from.

Who is Isaac Nuriani?

Isaac Nuriani, founder and CEO of Augusta Precious Metals started the company in 2012. His main goal for APM focuses on helping American investors make informed decisions with their retirement assets through the purchase of physical precious metals.

The company will handle all the paperwork on your behalf.

Nuriani's passion for integrity is what makes APM stand out as one of the best in the industry.

How is the customer service at Augusta Precious Metals?

APM IRA specialists offer high level expertise in the field. The customer service department are always available and will be more than happy to walk you through the process of buying precious metals or rolling over a 401k. Best of all, Augusta Precious Metals offers customer support for the lifetime of your account.

Can I monitor the performance of my gold IRA?

Yes, you can check the performance of your IRA investment online whenever you want. APM will also send you quarterly account statements to review your IRA investment performance..

What does an IRA specialist at APM do?

The IRA consultant or specialist will help you through the whole process. They will help you setup your precious metals accounts or rollover your existing IRA accounts as fast as possible. There is a choice of gold, silver, platinum and palladium precious metals or you can choose to hold all of them in your account.

What is the benefit of investing in physical gold and silver?

The value of silver and gold often remain stable or increases when conventional financial markets are declining and for this reason, many retirement investors have taken a special interest in precious metals as they seek to safeguard their portfolios through effective diversification.

Augusta Precious Metals