We may earn money from our partners when you click a link, complete a form or call a phone number.

Regal Assets Review: A Gold IRA Rollover Company

A top precious metals IRA company

Quality customer service

Committed to transparency

Outstanding customer reviews

Purchasing physical gold assets has long been a genius investment strategy of billionaires and the like for its intrinsic value that never wanes even when the economy and financial markets do.

In fact, history repeatedly shows that it is during these downturns when gold's value tends to increase the most, which is why they also often opt to buy it as part of their retirement plan for added security and confidence over the years.

Meanwhile, cryptocurrencies, such as Bitcoin, Litecoin, and more, have also been shown to be unaffected by bearish markets, declining dollar value, and more.

Therefore, they are also quickly becoming popular investment assets of the wealthy for their promise of stability too, and their value is also expected to continue to increase as they become more well known and used by individuals, businesses, and even governments, which in turn also helps generate income for your portfolio.

And now, with a Regal IRA, which is provided by Regal Assets, who is a leader in the precious metal industry and has been for more than 10 years, you can easily invest in both.

The company even allows you to pick your own metals and coins, while experts standby to help you pick the right assets for your goals, and you are also not limited to just making purchases for your retirement account.

In a Nutshell: Regal Assets is a leading provider of precious metals IRA rollover and so far they have maintained their good reputation in this industry for over ten years.

About Regal Assets

Regal Assets specializes in helping individual investors add metals and cryptos to their investment portfolios and retirement accounts in the easiest and most rejuvenating way. It is also the first company of its kind and the highest-rated alternative assets firm in the nation.

As a Regal IRA investor, you can choose from physical gold or silver bars as well as premium gold, silver, platinum, and palladium coins and over 25 different IRA-approved cryptocurrencies, including Ethereum, Dai, EOS, Bitcoin, and more.

Investors can also arrange for their precious metals to be stored in one of multiple global storage facilities located in stable and secure financial jurisdictions for added risk hedging, or you can opt to store them in your own home, provided you meet the IRS guidelines.

They also provide you with various resources for greater success, including information to help you avoid scams, the latest news affecting the precious metals and cryptocurrency industries, regularly updated gold, silver platinum, and palladium price charts, and more, to help you choose wisely and stay on top of your investments.

Individual Retirement Account Options Offered By Regal Assets

Regal Assets offers many services as part of their self-directed IRA account, including the ability to invest in both precious metals and cryptocurrencies, which can be funded via your current IRA, SEP, 401 (k), 403 (b), or Thrift Savings Plan, using their government-approved transfer and rollover services, or you can just deposit money right into the account.

As part of their services, you will also be provided a highly experienced custodian to assist you through the process. In fact, the firm partners with various leading companies and custodians throughout the alternative investment industry to assist their clients with building a well-diversified portfolio for maximum protection, and that also generates profits over the years as cryptocurrencies continue to increase in popularity for a true one-of-a-kind retirement account.

Some of their offerings include Credit Suisse Gold - Pamp Suisse Gold Bars, silver, platinum, and palladium bars and rounds, and gold and silver coins, including American Eagle coins, Canadian Leaf coins, as well as some of the world's top crypto assets, including Bitcoin, Ethereum, and Litecoin.

They also offer products outside of their retirement accounts for individual investors.

Advantages of Gold Investment

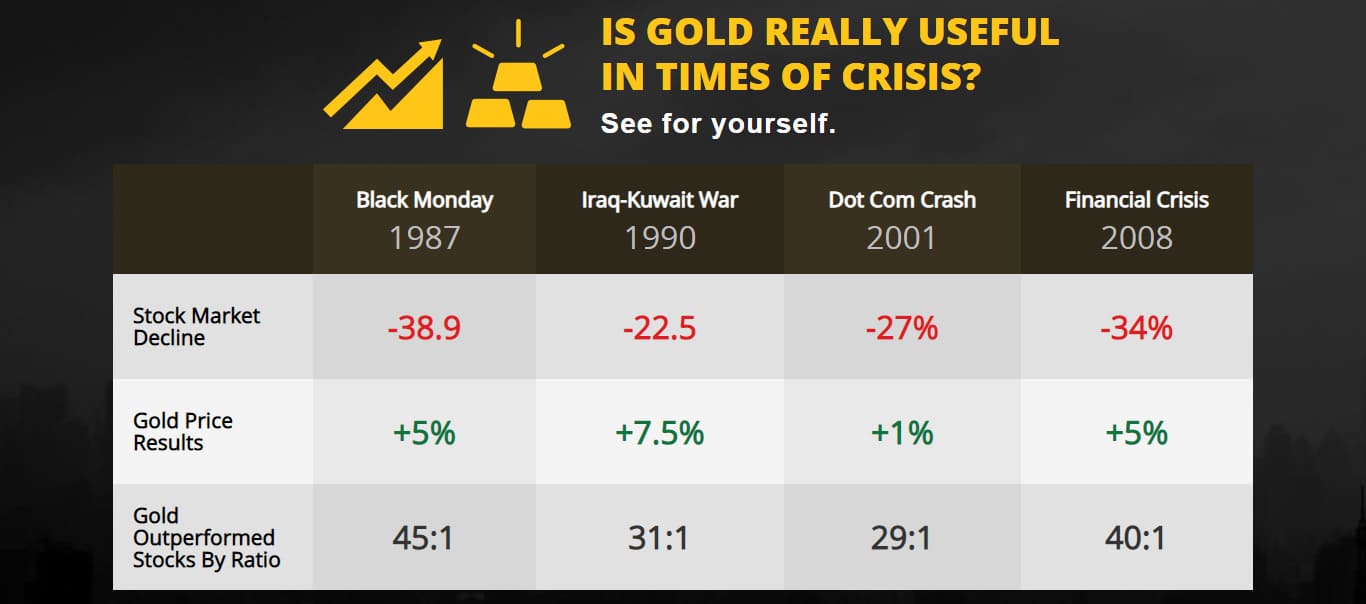

If you are still wondering whether investing in physical gold and precious metals will work for you, look at these numbers and see for yourself.

Diversifying your portfolio and also investing some of your money into precious metals, like silver or gold, is a way to secure yourself against a significant stock market crash. Many financial experts suggest having a varied portfolio with money invested in different locations as it is considered less risky.

In addition to helping you expand your portfolio, precious metals are simply a wise financial investment. Their value consistently increases throughout the years as they are in very high demand and in minimal supply.

Almost everybody is familiar with silver and gold fashion jewelry, yet did you know that the need for these metals for new technology is also growing? The continuous growth of the technological sector ought to give you some self-confidence that the value of precious metals will only continue to increase.

Rolling Over 401(k) To IRA

It can be a great way to get tax benefits by rolling over your 401k. Rolling over 401k to IRA gives consumers greater control. Unlike a company-sponsored plan (IRA), an individual retirement account (IRA), allows for a wider range of investments including stocks, bonds and precious metals.

Rolling over existing funds and creating a Gold IRA instead of buying gold to keep at home is one of the reasons that soon-to retire individuals choose this route. The tax advantages of precious metals in your account may mean not been taxed on any gains you make on your investment, depending on which type of account you have.

Before you roll over or set up a new self directed IRA, make sure to review the IRS guidelines, rules and penalties. Learn the age-based contribution limits to an IRA. You will be charged a 6% penalty each year if you exceed these limits until the error is fixed.

Also, you won't have the ability to withdraw funds from your account until you are at least 59 1/2. You will be charged a 10% fee to remove funds from your account before that date. Income tax will also apply to the money you withdraw. This rule is not applicable to death and disability.

Regal Assets will help you navigate through these guidelines with their streamlined, simple and fully transparent process. A team member is always available to answer any question you may have and offer assistance throughout the process.

Regal Assets Gold IRA And Silver IRA Coins

Gold American Eagle bullion

Gold American Eagle Proof

Gold Twin Maple Coins

Gold Buffalo Coin

Canadian Gold Maple Leaf Coin

Australian Gold Florin

Morgan Silver Dollar

Peace Silver Dollar

America the Beautiful Silver Series

American Silver Eagle (bullion)

Silver Twin Maples Coin

Why Choose A Precious Metals Investment With Regal Assets?

Self-directed IRAs, as you probably already know, are a great way for investors to diversify their portfolios and protect wealth from inflation.

The stock market crash or economic recession does not usually affect money invested in precious metals. The price of silver and gold tends to rise when stocks are down. This can provide additional security and benefits for diversified portfolios. The value of gold is stable and can often outperform other investments.

It is highly valued and sought-after, which is why it is so valuable. Gold is not only used to make jewelry but it can also be used in some technology and luxury products.

As technology advances make silver more valuable and popular, so is gold. Their value should not decline due to the constant demand for silver and gold.

You can also liquidate gold and silver when you are ready to sell them. However, this is not true for other types of investments like real estate. It will be simple to sell any or all of your Precious Metals IRA gold and silver when you are ready to retire. There are many sellers who will buy these metals from the retired.

Notable is the fact the gold price has grown almost twice as fast than the stock market over the past 20 years. This is what it would look like for your investment in gold and other precious metals.

How To Get Started with Regal IRA

To get started with Regal Assets, you can call the company directly to set up an account, or you can submit your information online using the account setup form, after which time a member of their team will contact you within 24 hours to complete your sign up.

Once you have successfully set up an account, the next step is to fund it, which you can do directly, or you can fund it using your previous retirement account.

To fund your account using your existing IRA, SEP, 401(k), 403 (b), or TSP plan, you simply work with a custodian to transfer the funds for you, and you can make transfers as often as you'd like.

Or you can receive the distribution from your current retirement account yourself and then deposit it into a Regal Assets custodial account, penalty-free, also known as a rollover.

A rollover can be done anytime, tax-free, provided the funds are redeposited into the new retirement account within 60 days, and the asset goes from custodian to custodian.

The company also provides a wide selection of products for investors who want to make purchases outside their retirement accounts.

Who is Regal Assets Best For?

Regal Assets' innovative approach to retirement investing makes it a suitable choice for the modern investor who wants to benefit from the profit-earning potential of the digital currency craze while also enjoying the safety and stability of more classic, time-proven gold assets and other precious metals.

Their IRA accounts are also self-directed, so it is also for those who want more control over choosing the investments in their retirement portfolio as opposed to solely depending on an investment manager.

How To Get Started with Regal Assets

To get started with Regal Assets, you can call the company directly to set up an account, or you can submit your information online using the account setup form, after which time a member of their team will contact you within 24 hours to complete your sign up.

Once you have successfully set up an account, the next step is to fund it, which you can do directly, or you can fund it using your previous retirement account.

To fund your account using your existing IRA, SEP, 401(k), 403 (b), or TSP plan, you simply work with a custodian to transfer the funds for you, and you can make transfers as often as you'd like.

Or you can receive the distribution from your current retirement account yourself and then deposit it into a Regal Assets custodial account, penalty-free, also known as a rollover.

A rollover can be done anytime, tax-free, provided the funds are redeposited into the new retirement account within 60 days, and the asset goes from custodian to custodian.

The company also provides a wide selection of products for investors who want to make purchases outside their retirement accounts.

Final Thoughts on Regal Assets

As the Regal IRA promises, it definitely has the professional, cutting edge appeal to attract even the most discerning investor with its modern touch of the most notable digital currencies for excelled performance over traditional portfolios and the classic, intrinsic value and staying power of physical gold to back it up.

Not to mention, the skilled, unrivalled support provided by the industry's top professionals also provides investors with an edge like no other for greater confidence in their investments and a true one-stop-shop experience that helps eliminate the need to search elsewhere to enhance their portfolio.

And since it is a self-directed IRA, you can also rest peacefully knowing your portfolio's success is based on your own sound, educated choices as opposed to an investment account manager who may simply just be trying to meet the numbers.

No matter which storage facility you choose to house your physical gold, you can also sleep at night knowing it's in a safe, stable financial jurisdiction, which you can even personally visit if you'd like.

For these reasons, and more, Regal Assets stands out as a promising alternative asset investment company, and it is also a member of the Forbes Council, as well as also regularly featured in many reputable publications, including Bloomberg, Express.co.uk, the Huffington Post, and more, which also gives you greater confidence knowing they have a stellar reputation to live up to.

Frequently Asked Questions About Regal Assets Gold IRA

Is Regal Assets a reputable company?

Regal Assets, with its outstanding consumer ratings and competitive pricing structure has been a leader in gold IRA companies ever since it opened its doors in 2010.

When a company like Regal deals majorly in IRA rollovers, it deserves special recognition as the best gold IRA company for IRA rollovers. Regal Assets supports that recognition with its superior IRA transfer and rollover expertise and services.

Does a gold IRA earn interest like a traditional IRA?

A gold IRA does not earn interest in the same way a traditional IRA does because the investment is tied to the commodity's value. Instead, the value of your gold IRA is measured by the market price of the precious metals you own at any given time.

What are the setup and storage fees for a gold IRA in Regal Assets?

Regal's fees are transparent and simple. The company charges $250 per annum for storage and service. This fee covers the cost of segregated storage which is less than other firms. There are no transaction fees. There may be a minimum investment. If you are interested in investing with the company, contact them for more information.

Who owns Regal Assets?

Regal Assets was founded in 2009 by investor Tyler Gallagher. It is one of the most successful Precious Metals IRA companies in the country. The company was also ranked #20 in the U.S. by the famous INC 500 in the financial services category.

Are gold IRAs a good investment?

For those who wish to safeguard their assets in the event of a downturn, the gold IRA is a great investment. The fees for the Gold IRA are higher than those of the Roth IRA. However, the Gold IRA can be a safe place to go if stocks, bonds or mutual funds fall.

How can I set up a gold IRA if I already have an IRA or 401(k)?

Regal Assets offers two options for you: a rollover or a transfer. Direct transfers allow you to move money from one IRA to another. You can make transfers as many times as you like.

You would act as an intermediary between two IRA accounts for a rollover. You can deposit the distribution you have received from your first account into a Regal Assets Gold IRA account.

Regal Assets